Financial Intelligence in Motion

The AI-native platform that unifies customer insights, product strategy and pricing execution.

Features

A platform built for how financial institutions really work

Integrated with existing systems and workflows, empowering business users with intelligence across the product portfolio.

Financial Intelligence Engine

Drive targeted pricing and customer and product insights with an AI-powered analytics engine.

Learn morePrice

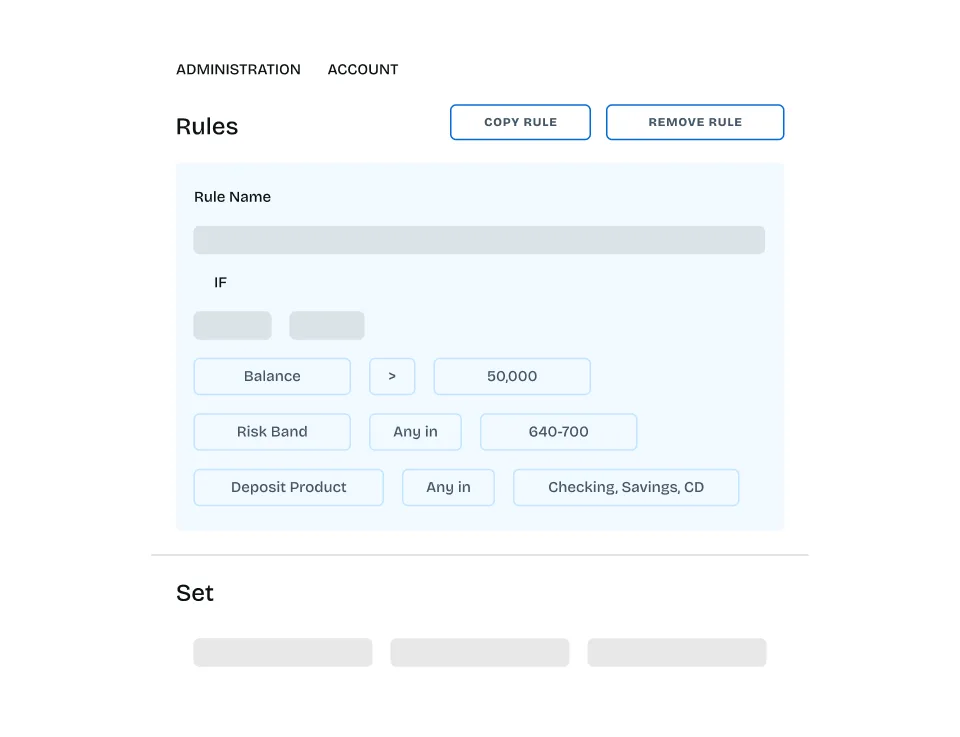

Management

Execute targeted pricing and campaigns across all channels with agility.

Learn moreOpportunity

Management

Manage individual pricing opportunity approval workflows, synced with origination systems.

Learn moreLoan

Optimization

Balance volume and profitability with constraint-based modeling across lending portfolios.

Learn moreDeposit

Optimization

Model rate strategies that balance growth objectives with profitability across deposit products.

Learn moreChannel

Integrations

Deliver rate sheets and offers in real-time to core systems, digital platforms and origination channels.

Unified intelligence, from insight to execution

Customer Insights

Understand behaviors, target cohorts and trigger timely actions based on customer intelligence.

Product Strategy

Design optimal product structure, mixes and bundles that balance growth, profitability and customer needs.

Pricing Execution

Deploy targeted rates, manage campaigns and deliver personalized pricing across all channels.

Benefits

Transform fragmented data into unified intelligence

Personalize every customer interaction at scale

Deliver the right products, at the right prices, at the right moment across your entire portfolio.

Seamlessly connect insights, strategy and execution

Unite customer insights, product strategy and pricing decisions in one platform.

Accelerate growth with AI-powered decision intelligence

Amplify your team's expertise with proactive recommendations that drive measurable results.

How it works

Turning data into decisive action

Our impact

Proven results across financial institutions

Our data-driven solutions have consistently delivered measurable improvements for banks, credit unions, and auto lenders across multiple performance metrics.

20+

Years powering pricing solutions

$2.3T

In combined assets and liabilities served through Nomis programs

60%

Average reduction in rate management effort

Schedule a demo

Learn how top financial institutions use Nomis to drive results. Book your personalized demo today.