Loan Optimization

Balance profitability and volume objectives with precision pricing intelligence across your lending portfolio.

Features

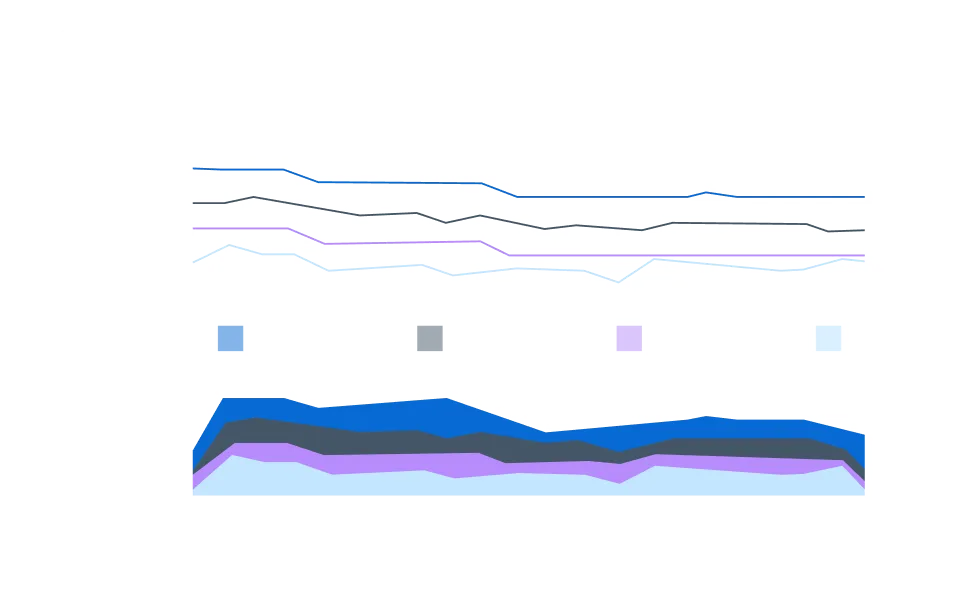

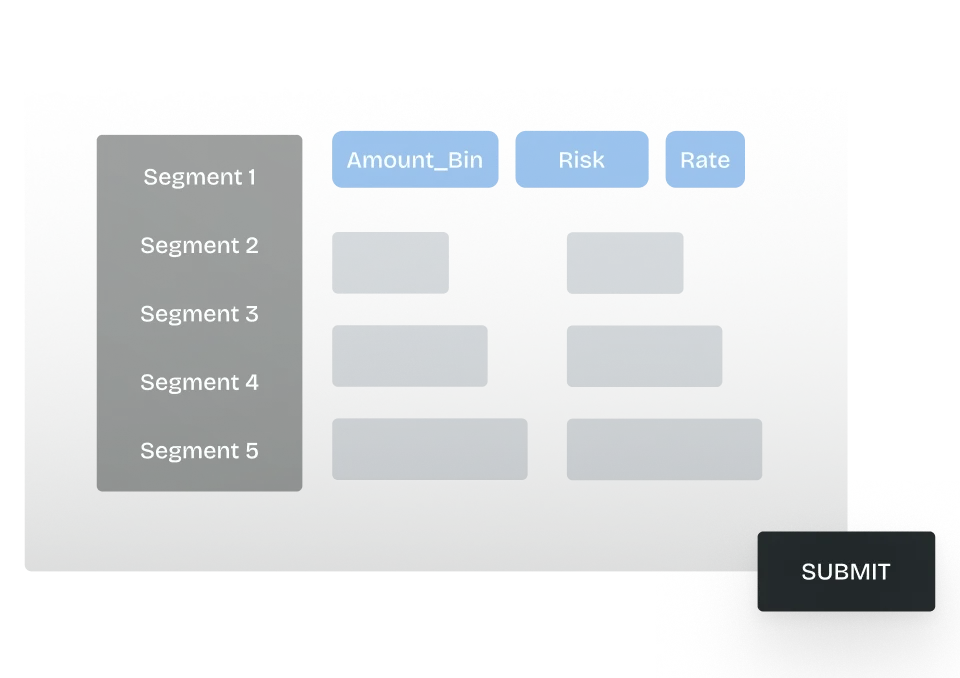

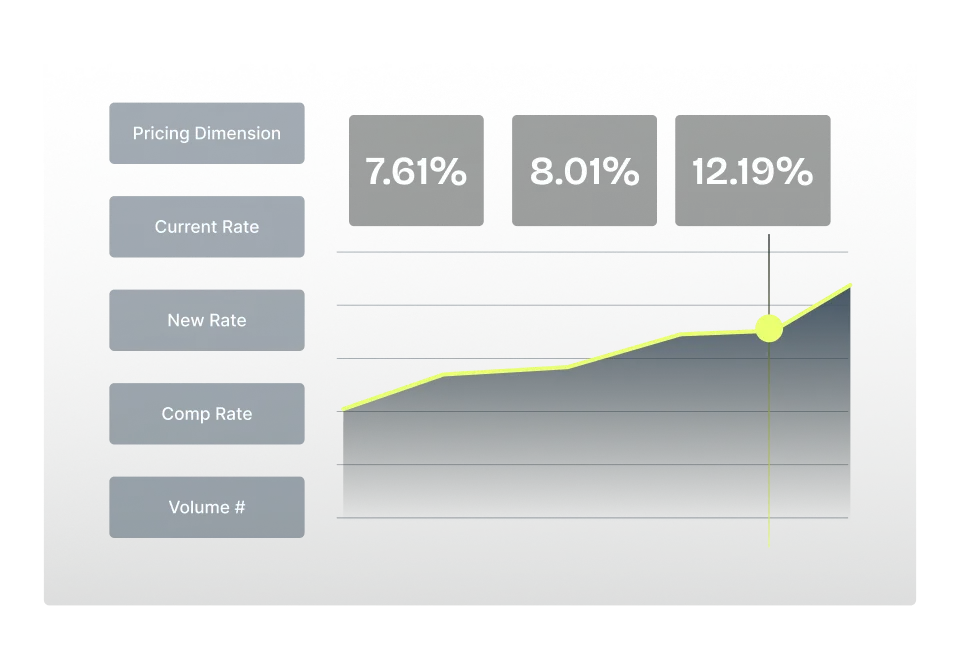

Constraint-Based Portfolio Optimization

Leverage proven optimization techniques and sophisticated price response models to simultaneously evaluate thousands of pricing scenarios and identify optimal rate strategies.

How it works

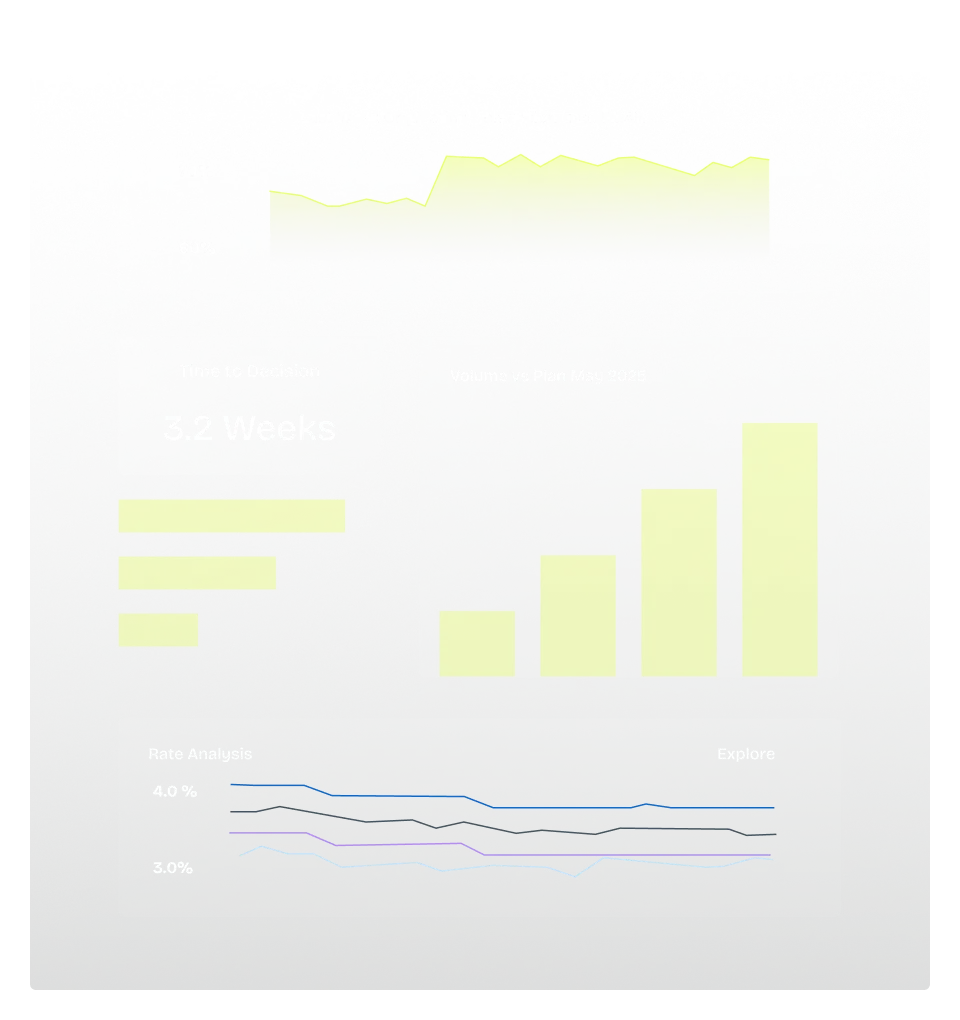

Add intelligence to pricing and campaigns

Move from defense to offense with data-driven insights throughout the workflow.

Benefits

Improve margins and win rates without sacrificing credit quality

Deliver measurable results across your lending portfolio, increasing margins while strengthening risk management.

Grow with precision

Maximized portfolio performance

Increase loan volume and margins simultaneously with precision pricing across portfolios.

Operate confidently

Stronger risk management

Mitigate portfolio risk with data-informed pricing that accounts for loss rates and credit risk.

Build your moat

Fortified competitive edge

Adapt proactively to market changes with dynamic pricing strategies that outpace rivals.

Get lean

Improved efficiency

Reduce rate management effort by 60% while increasing confidence in pricing decisions.

Schedule a demo

Learn how top financial institutions use Nomis to drive results. Book your personalized demo today.