Deposit Optimization

Balance growth and profitability objectives with precision pricing intelligence across your deposit portfolio.

Features

Constraint-Based Deposit Optimization

Leverage sophisticated price response models and behavioral analytics to optimize deposit pricing across segments while balancing volume and profitability trade-offs.

Rate Sensitivity Analytics

Surface customer price sensitivity and behavioral patterns to inform rate strategies.

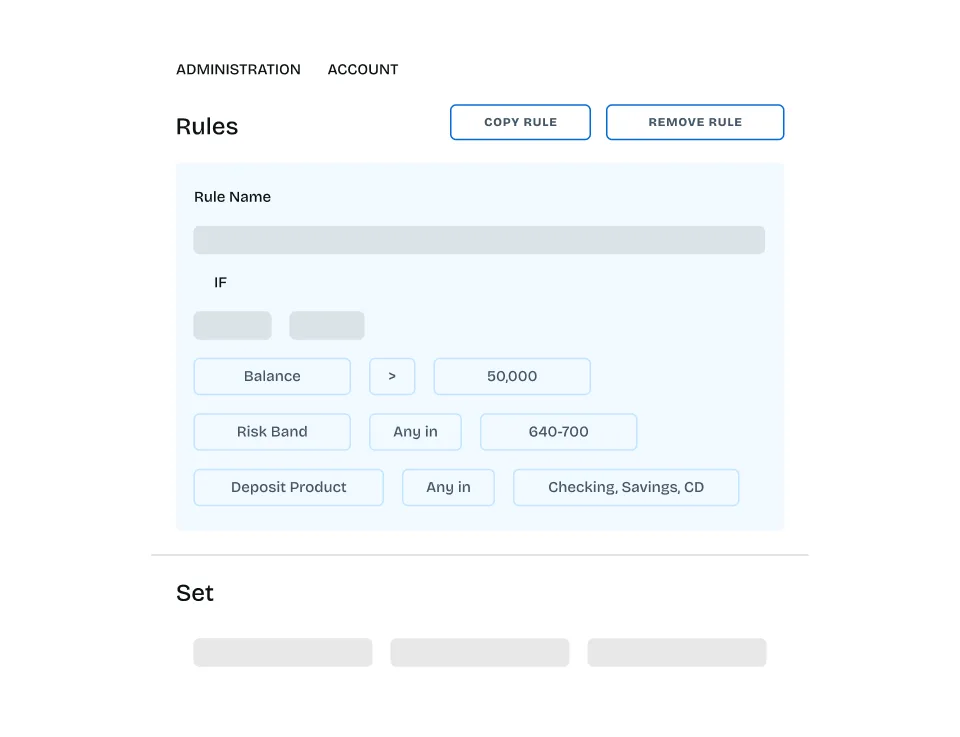

How it works

From portfolio intelligence to rate execution

Integrate deposit optimization within the Nomis platform workflow.

Benefits

Reduce funding costs without sacrificing growth

Deliver measurable results across your deposit portfolio–optimizing rate strategies to achieve balance and profitability goals while strengthening competitive positioning.

Operate at a high level

Optimized portfolio performance

Achieve balance sheet objectives while maximizing profitability across deposit products.

See the future

Elevated forecasting accuracy

Increase forecast precision with data models informed by customer price sensitivity.

Invest in what matters

High-value relationship retention

Balance volume and margin objectives to strengthen relationships with valued customers.

Fast is profitable

Accelerated decision velocity

Execute faster with automated updates of pricing and portfolio data in one system.

Compliance prioritized

Improved pricing transparency

Ensure regulatory compliance with comprehensive model documentation and audit trails.

Schedule a demo

Learn how top financial institutions use Nomis to drive results. Book your personalized demo today.