Customer Insights

Transform customer data into actionable intelligence that drives precision targeting and proactive retention strategies.

Features

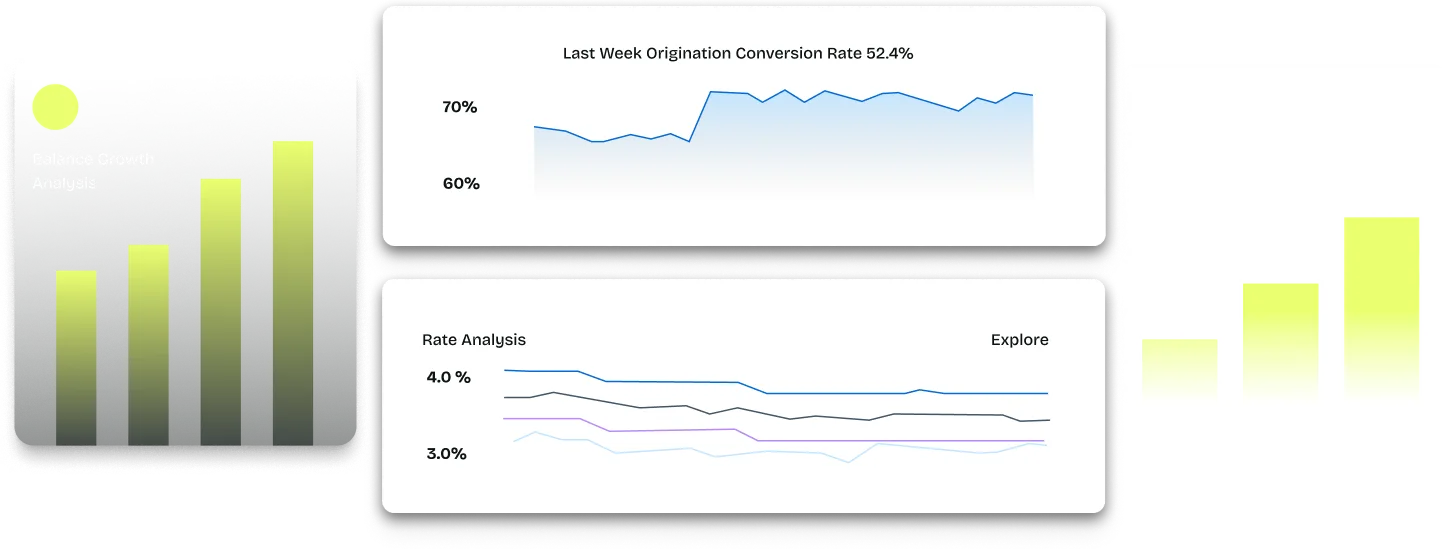

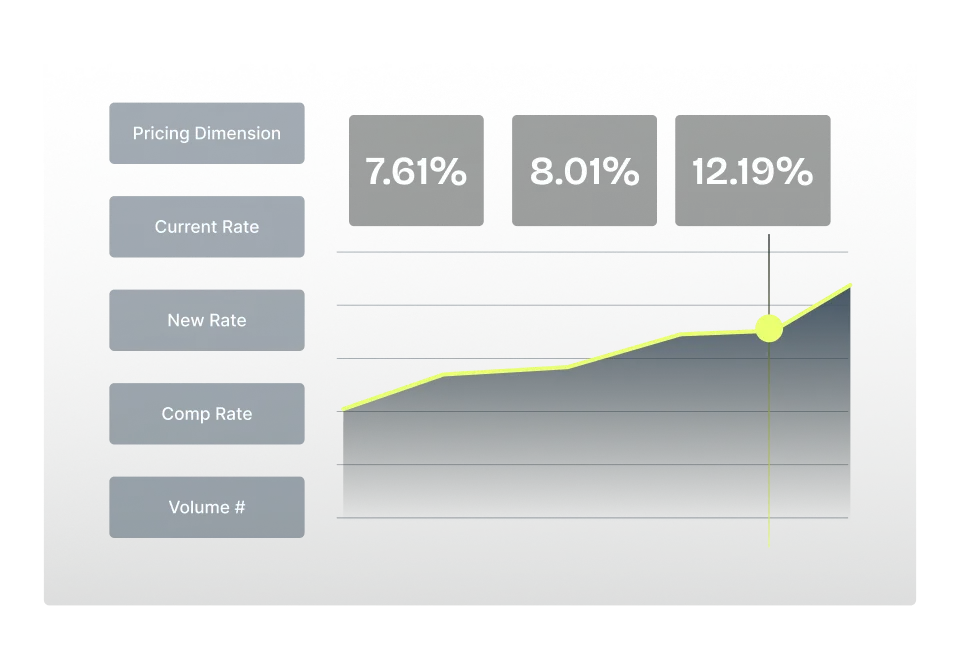

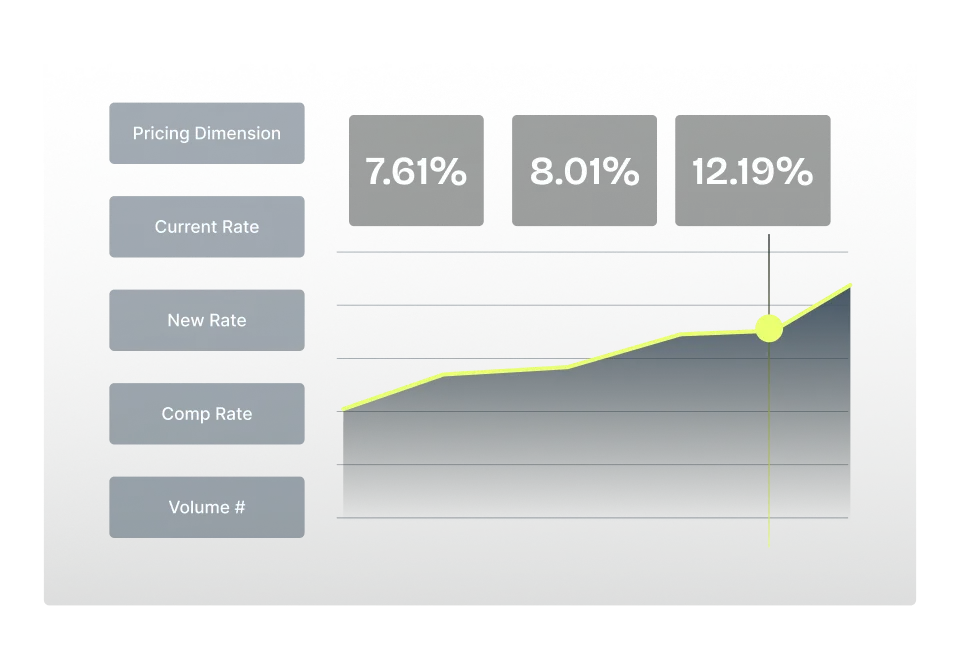

Behavioral Pattern Recognition

Surface latent features that reveal which customers benefit most from specific treatments, transforming broad campaigns into targeted strategies that deliver real results.

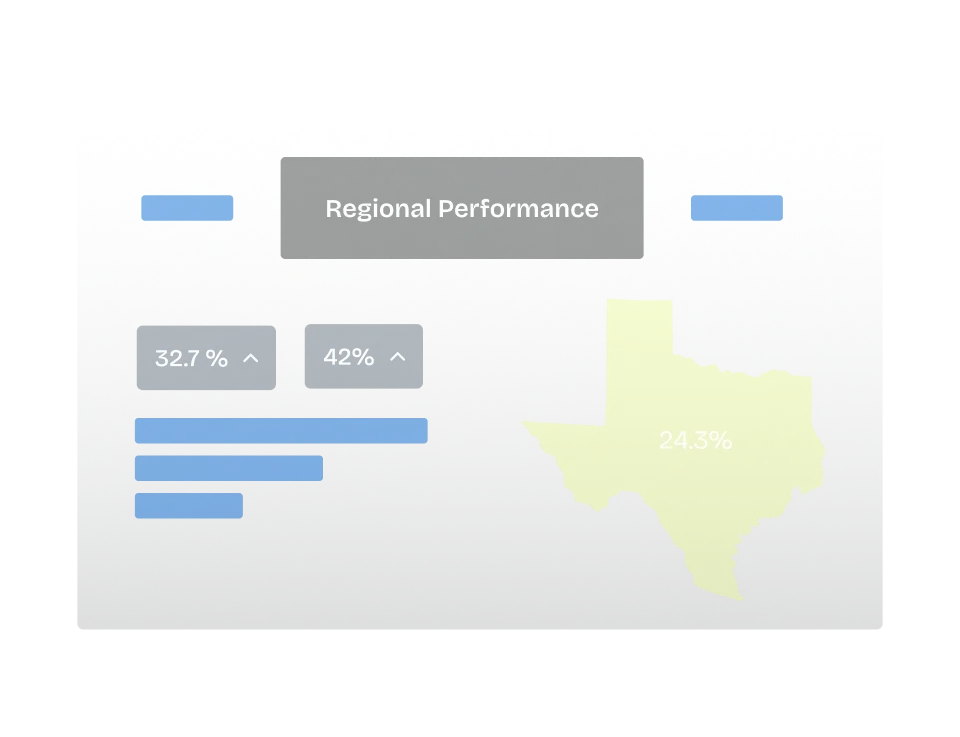

Competitive Flow Analysis

Track customer balance movements to competitor institutions and identify at-risk relationships before they defect, empowering proactive retention offers that protect high-value accounts.

Cohort Performance Tracking

Monitor how customers respond to campaigns and product changes over time to uncover behavioral shifts and fuel smarter targeting.

Benefits

The power of knowing your customers on the deepest level

Operate at a high level

Improved campaign effectiveness

Target customers who will respond rather than broad segments, increasing conversion rates.

See the future

Reduced customer attrition

Identify at-risk relationships before balances leave and act with proactive retention offers.

Invest in what matters

Maximized marketing ROI

Eliminate wasted spend on customers unlikely to respond with precision-targeted campaigns.

Fast is profitable

Unmatched personalization, beyond marketing

Meet customer expectations for experiences as unique as their financial situations.

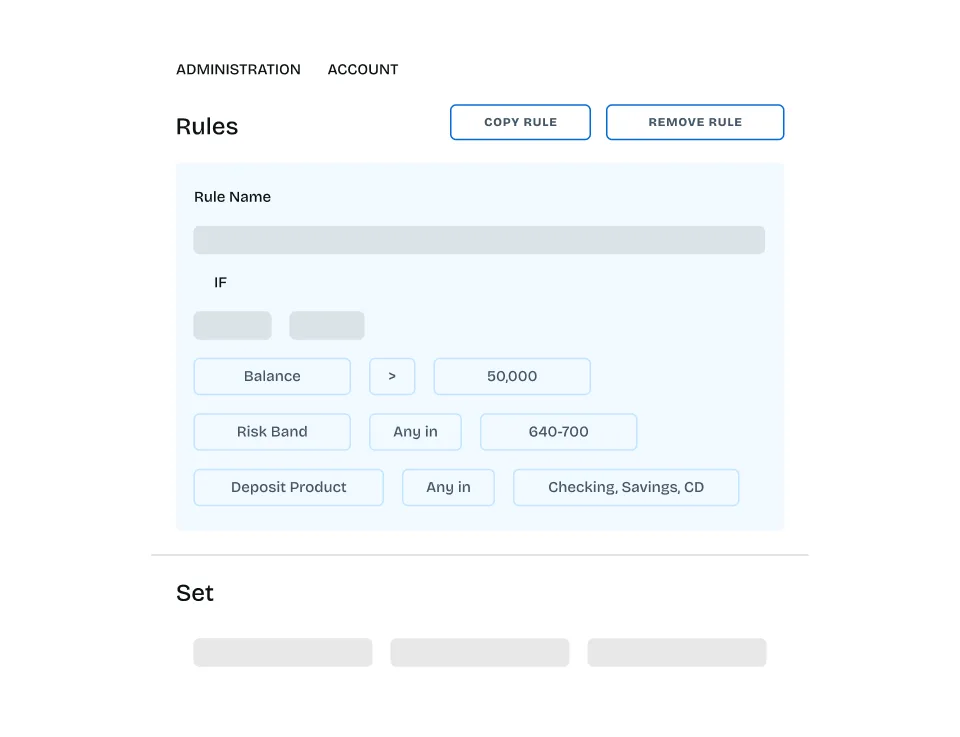

How it works

From customer insight to targeted action

Innovation throughout the workflow, from understanding customer behaviors to executing targeted strategies.

Schedule a demo

Learn how top financial institutions use Nomis to drive results. Book your personalized demo today.