Why Nomis?

Point solutions create silos. Financial institutions need unified intelligence that connects what others fragment, enabling smarter decisions across the complete workflow.

What makes Nomis different?

Build different from the ground up

After 20+ years and hundreds of implementations, we’ve built what the market demands—a unified platform that connects insights, strategy and execution.

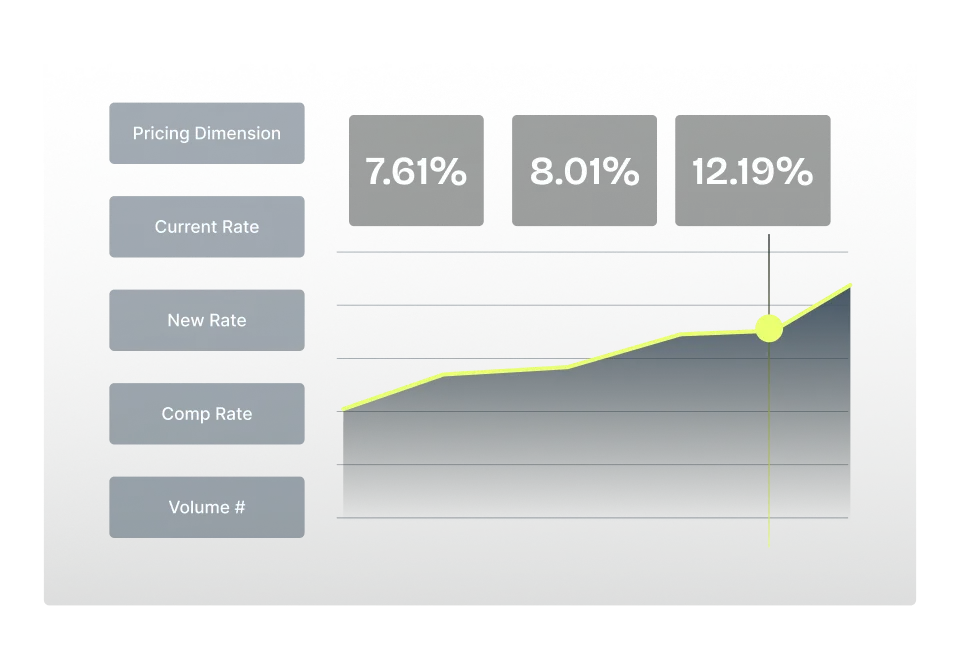

Intelligence through execution, not just insights

Competitors stop at optimization or analytics. We enable the complete workflow—evaluate, design, deploy and analyze—so insights actually drive action.

Start where you are, expand as you grow

Our modular platform meets institutions at their current maturity level and scales with their needs. No rip-and-replace, no unnecessary complexity.

Personalization beyond marketing messaging

True personalization isn't just customized emails. It's delivering the right products, at the right prices, at the right moment for each unique customer.

From insight to marketing in days, not months

Our unified platform eliminates manual handoffs between systems. Identify opportunities, design strategies and deploy campaigns at the optimal time.

Intelligence that learns from every deployment

We don't just report results. We close the loop by tracking performance, analyzing effectiveness and feeding learnings back into strategy for continuous improvement.

AI that enhances your team’s expertise

We embed industry expertise to support your decision-making, not override it. Our AI surfaces insights and recommends actions while your team maintains strategic control.

The Nomis advantage

Deliver true personalization at scale

Move beyond customized marketing to the right products, at the right prices, at the right moment.

Simple is better

Reduce operational complexity

Consolidate multiple vendor licenses and integrations into one platform that spans your balance sheet.

Best of both worlds

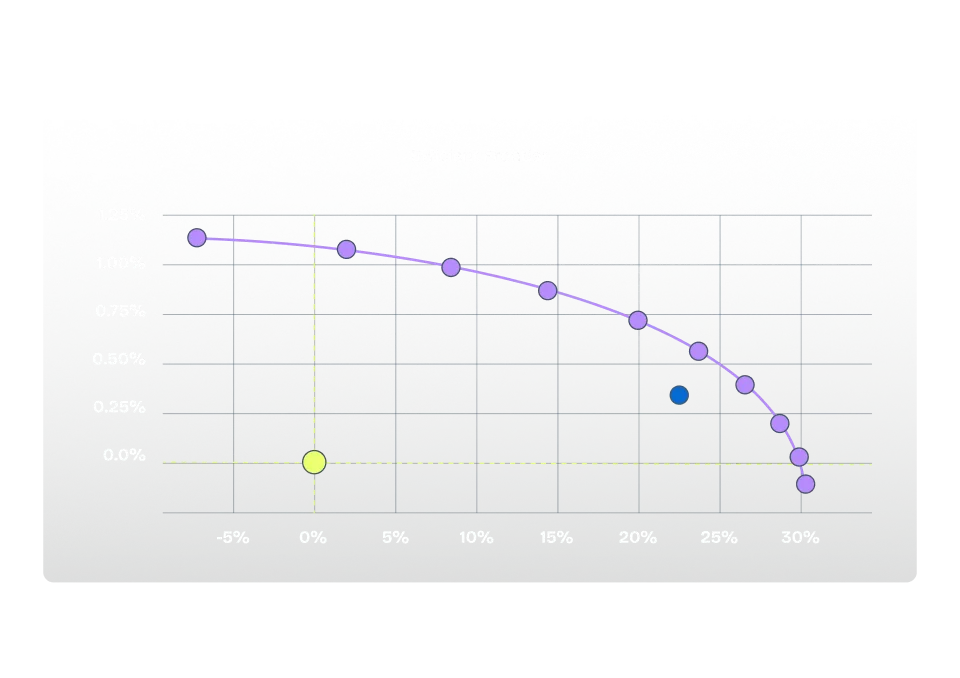

Expand margins without sacrificing growth

Balance profitability and volume targets across your entire portfolio with precision targeting.

Mitigate attrition

Improve acquisition and retention

Respond to competitive threats proactively and design offers that keep high-value customers engaged.

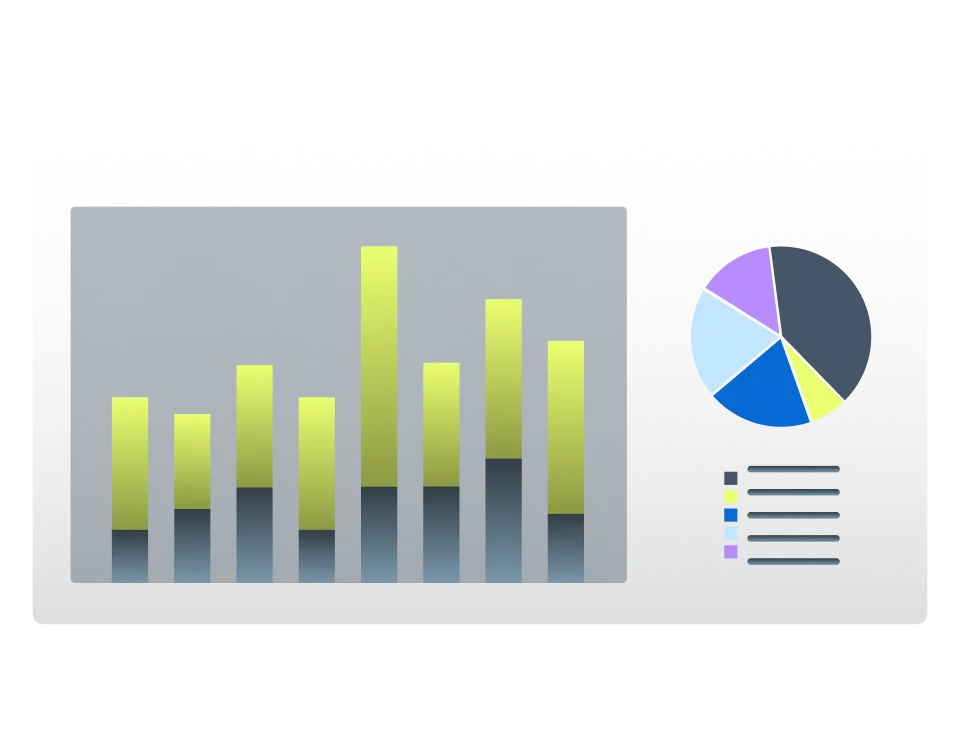

Benefit from a bird’s eye view

Make smarter decisions with complete visibility

Track what’s working across customer segments, product lines and channels in one unified view.

The financial institutions we serve

Banks

Balance personalization across complex product portfolios while managing regulatory requirements and risk.

Credit unions

Compete with larger institutions by delivering member-focused pricing and targeted retention strategies.

Auto lenders

Optimize dealer incentives and segment-level profitability across high-volume loan originations.

Schedule a demo

Learn how top financial institutions use Nomis to drive results. Book your personalized demo today.